Diving into Understanding Critical Illness Cover: What’s Actually Covered?, this introduction presents a captivating overview of the topic, setting the stage for an informative and engaging discussion.

The subsequent paragraphs will provide detailed insights into critical illness cover, shedding light on its importance and various aspects for the readers to grasp.

Understanding Critical Illness Cover

Critical illness cover is a type of insurance policy that provides a lump sum payment if the policyholder is diagnosed with a critical illness that is covered by the policy. This payment can be used to cover medical expenses, loss of income, or any other financial obligations that may arise due to the illness.

Qualifying as a Critical Illness

- Heart attack

- Stroke

- Cancer

- Organ transplant

- Kidney failure

- Multiple sclerosis

Difference Between Critical Illness Cover and Health Insurance

Critical illness cover pays out a lump sum if you are diagnosed with a critical illness covered by the policy, regardless of whether or not you are able to work. On the other hand, health insurance covers the cost of medical treatment and hospitalization, but does not provide a lump sum payment for lost income or other expenses related to the illness.

Coverage Details

When it comes to critical illness cover, it's important to understand what exactly is covered by insurance policies. This includes a list of common critical illnesses covered, the financial benefits provided in case of a critical illness, as well as any exclusions or limitations in coverage.

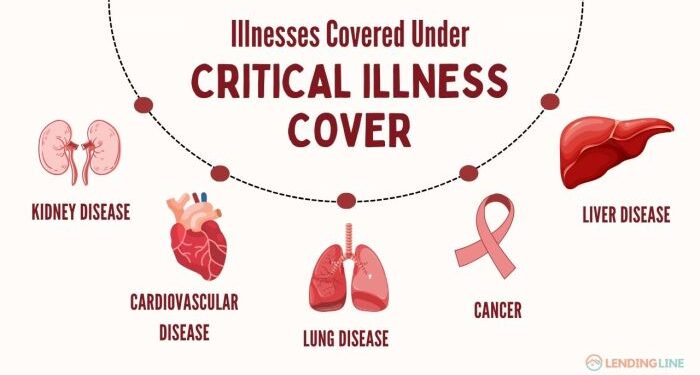

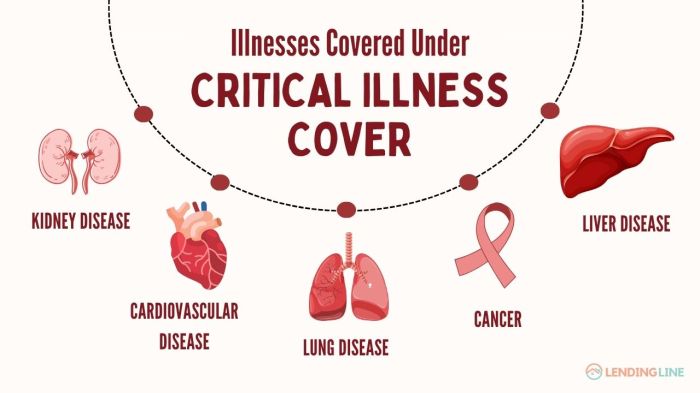

Common Critical Illnesses Covered

- Cancer

- Heart attack

- Stroke

- Organ transplant

- Kidney failure

Financial Benefits

In the event of a critical illness, the insurance policy typically provides a lump sum payment to the policyholder. This lump sum can be used to cover medical expenses, ongoing care, loss of income, or any other financial needs that may arise during the recovery period.

Exclusions and Limitations

- Pre-existing conditions may not be covered under the policy.

- Some policies may have waiting periods before coverage kicks in.

- Certain lifestyle choices, such as smoking or hazardous activities, may result in limitations or exclusions in coverage.

Claim Process

When it comes to making a claim for a critical illness, there are specific steps involved that policyholders need to follow. Understanding the process and having the necessary documentation ready can help ensure a smoother experience during a challenging time.

Steps Involved in Making a Claim

- Notify the insurance provider: The first step is to inform your insurance provider about the critical illness diagnosis. This can usually be done by contacting them through phone or email.

- Submit claim form: The next step is to fill out and submit a claim form provided by the insurance company. This form will require details about the illness, treatment received, and other relevant information.

- Medical assessment: In some cases, the insurance company may require a medical assessment by a healthcare professional to validate the claim.

- Submit necessary documentation: Along with the claim form, you will need to submit supporting documents such as medical reports, diagnosis records, treatment invoices, and any other relevant paperwork.

- Wait for claim approval: After submitting all the required documents, the insurance company will review the claim and assess its validity. The timeline for processing a claim can vary depending on the complexity of the case.

Documentation Required for a Successful Claim

- Medical reports: Detailed medical reports from healthcare providers confirming the critical illness diagnosis.

- Diagnosis records: Official documents specifying the type and severity of the illness.

- Treatment invoices: Receipts and invoices for the medical treatments received.

- Other relevant paperwork: Any additional documents requested by the insurance provider to support the claim.

Typical Timeline for Processing a Claim

It is important to note that the timeline for processing a claim can vary depending on the insurance provider, the complexity of the case, and the completeness of the documentation provided.

- Initial review: The insurance company will conduct an initial review of the claim to determine its validity.

- Further assessment: If additional information or documentation is required, there may be a further assessment stage before a decision is made.

- Claim approval: Once the claim is approved, the insurance provider will proceed with the disbursement of the claim amount as per the policy terms.

Premiums and Policy Options

When it comes to critical illness cover, understanding how premiums are calculated and the different policy options available in the market is crucial for making an informed decision. Let's delve into the details.

Premium Calculation

Premiums for critical illness cover are typically calculated based on several factors such as age, gender, health condition, smoking status, coverage amount, and term length. Insurance companies assess the risk profile of the individual applying for coverage and determine the premium accordingly.

Younger individuals without pre-existing medical conditions generally pay lower premiums compared to older individuals or those with health issues.

Policy Options

There are various policy options available in the market for critical illness cover, ranging from standalone policies to riders attached to life insurance policies. Standalone policies offer comprehensive coverage specifically for critical illnesses, while riders provide additional coverage alongside a base life insurance policy.

It's essential to compare the features, benefits, and exclusions of different policy options to choose one that best suits your needs.

Factors Affecting Premium Costs

Several factors can affect the premium costs of critical illness cover. These include age, lifestyle habits such as smoking, pre-existing medical conditions, coverage amount, term length, and the type of policy chosen. Generally, individuals with higher risk profiles tend to pay higher premiums to offset the increased likelihood of claiming benefits due to critical illnesses.

It's important to disclose all relevant information truthfully during the application process to ensure accurate premium calculations and avoid claim denials in the future.

Importance of Critical Illness Cover

Having critical illness cover is crucial for providing financial protection and peace of mind to individuals and families in times of need.

Financial Protection

- Critical illness cover can help cover medical expenses that may not be fully covered by regular health insurance.

- It can provide a lump sum payment upon diagnosis of a critical illness, which can be used for treatment, rehabilitation, or even to replace lost income.

- Individuals and families won't have to worry about the financial burden of expensive treatments, allowing them to focus on recovery instead.

Peace of Mind

- Knowing that you have critical illness cover can bring peace of mind, as it ensures that you and your loved ones will be taken care of in case of a serious health issue.

- It offers a sense of security and relief, knowing that there is a financial safety net in place to handle unexpected medical emergencies.

- Having this insurance can alleviate the stress and anxiety associated with the potential financial strain of a critical illness diagnosis.

Final Wrap-Up

In conclusion, the discussion on Understanding Critical Illness Cover: What’s Actually Covered? offers a comprehensive understanding of the topic, emphasizing its significance and benefits.

User Queries

What is critical illness cover?

Critical illness cover is a type of insurance that provides a lump sum payment upon diagnosis of a specified critical illness.

What are some common critical illnesses covered by insurance?

Common critical illnesses covered include cancer, heart attack, stroke, and organ transplants.

How are premiums calculated for critical illness cover?

Premiums are calculated based on factors such as age, health condition, coverage amount, and lifestyle habits.

Why is having critical illness cover important?

Having critical illness cover is crucial as it provides financial protection during challenging times and offers peace of mind to individuals and families.