Exploring the realm of Small Business Health Insurance Providers unveils a landscape filled with crucial decisions and intricate details. This guide aims to shed light on the key factors to consider when comparing different providers, ensuring that businesses can make informed choices for their employees' health coverage needs.

Delving into the nuances of coverage options, costs, benefits, and customer support, this guide navigates the complexities of selecting the right health insurance provider for small businesses.

Researching Small Business Health Insurance Providers

When it comes to finding the right small business health insurance provider for your company, it's important to conduct thorough research to ensure you're getting the best coverage for your employees. Here are some key factors to consider:

Top Small Business Health Insurance Providers

- Blue Cross Blue Shield

- Aetna

- Cigna

- UnitedHealthcare

Coverage Options

- Blue Cross Blue Shield: Offers a wide range of coverage options including HMOs, PPOs, and high-deductible plans.

- Aetna: Provides customizable plans to fit the needs of small businesses, including wellness programs and telemedicine services.

- Cigna: Known for its comprehensive coverage options and focus on preventive care.

- UnitedHealthcare: Offers a variety of plan options with access to a large network of healthcare providers.

Healthcare Provider Networks

- Blue Cross Blue Shield: Has a vast network of healthcare providers nationwide, ensuring easy access to quality care.

- Aetna: Partners with a wide range of healthcare providers to offer extensive coverage and services.

- Cigna: Works with a diverse network of healthcare professionals to provide comprehensive care options.

- UnitedHealthcare: Offers access to a broad network of doctors, hospitals, and specialists for enhanced healthcare services.

Customer Reviews and Satisfaction Ratings

- Blue Cross Blue Shield: Receives positive reviews for its coverage options and customer service.

- Aetna: Known for its responsive customer support and user-friendly online tools.

- Cigna: Receives high ratings for its network of providers and ease of claims processing.

- UnitedHealthcare: Customers appreciate the variety of plan options and quality of care provided.

Cost and Affordability

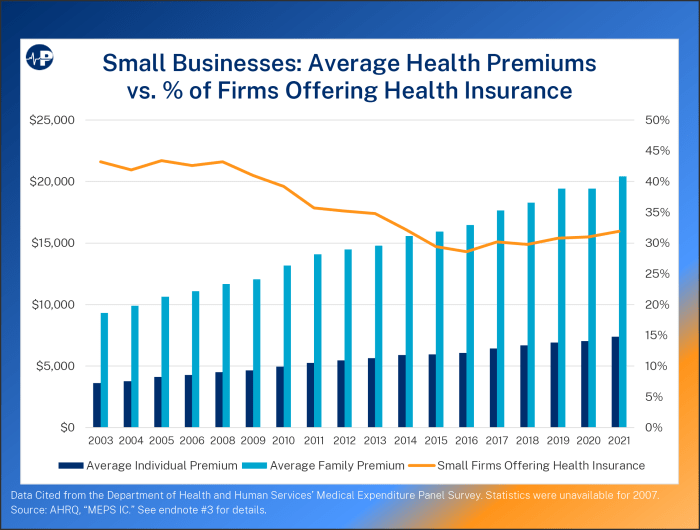

When it comes to small business health insurance providers, understanding the cost and affordability is crucial for making the right decision. Let's delve into the details to help you navigate through this important aspect.

Premium Comparison

- Compare the cost of premiums for different small business health insurance providers to see which one offers the most competitive rates.

- Look at the coverage provided by each plan to ensure you are getting value for the premiums you pay.

Out-of-Pocket Expenses

- Analyze the out-of-pocket expenses such as deductibles and copayments to determine the overall cost of the plan beyond the premiums.

- Consider how these expenses may impact your employees and their ability to access healthcare services.

Discounts and Incentives

- Explore if the insurance providers offer any discounts or incentives for small businesses, such as wellness programs or bulk discounts.

- Take advantage of these offerings to lower the overall cost of providing health insurance to your employees.

Cost-Saving Strategies

- Look for ways to save costs while selecting a suitable health insurance provider for your small business, such as negotiating rates or bundling services.

- Consider implementing cost-sharing strategies with your employees to reduce the financial burden on both parties.

Coverage and Benefits

When choosing a small business health insurance provider, it's crucial to consider the types of coverage and benefits offered to ensure that your employees have access to the care they need.

Types of Coverage Available

- Medical: This includes coverage for hospital visits, doctor's appointments, surgeries, and other medical services.

- Dental: Some plans may offer dental coverage for preventive care, basic procedures, and major treatments.

- Vision: Vision coverage typically includes eye exams, glasses, and contact lenses.

- Mental Health Services: Coverage for mental health services such as therapy and counseling may also be included.

Benefits Comparison

- Prescription Drug Coverage: Evaluate the coverage for prescription medications and any associated costs.

- Preventive Care: Look for benefits that cover preventive services like vaccinations and screenings at no additional cost.

- Maternity Care: Consider the coverage for prenatal care, labor and delivery, and postpartum services.

Additional Perks

- Wellness Programs: Some providers offer wellness programs to promote healthy habits and prevent chronic conditions.

- Telemedicine Services: Access to virtual healthcare services can be a convenient perk for employees.

Customizing Coverage Options

- Flexibility: Evaluate the flexibility in customizing coverage options based on the specific needs of your small business and employees.

- Optional Add-ons: Some providers may offer optional add-ons for additional coverage based on your preferences.

Enrollment Process and Customer Support

When it comes to small business health insurance, the enrollment process and customer support are crucial aspects to consider. The ease of enrollment and the quality of customer support can greatly impact your overall experience with the insurance provider.

Enrollment Process

- Research different insurance providers and their plans to find the best fit for your business and employees.

- Submit an application for the chosen plan, providing necessary information about your business and employees.

- Review and compare the quotes received from different providers to make an informed decision.

- Once a plan is selected, complete the enrollment forms and provide employee information for coverage.

Customer Support

- Availability of Support Channels: Check if the insurance provider offers phone, email, or live chat support for customer queries.

- Responsiveness: Evaluate how quickly the customer support team responds to your inquiries or concerns.

- Helpfulness: Assess the quality of assistance provided by the customer support team in addressing your questions and issues.

Final Conclusion

In conclusion, the process of comparing Small Business Health Insurance Providers is a vital step in securing quality healthcare coverage for employees. By weighing factors like cost, coverage, and customer support, businesses can make well-informed decisions that prioritize the well-being of their workforce.

Question & Answer Hub

What factors should I consider when comparing Small Business Health Insurance Providers?

When comparing providers, consider coverage options, costs, benefits such as prescription drug coverage, and the quality of customer support.

Are there any discounts available for small businesses when choosing health insurance providers?

Some insurance providers offer discounts or incentives for small businesses, so it's worth exploring these options to save costs.

How can I customize coverage options based on my small business needs?

Look for providers that offer flexibility in customizing coverage to tailor to the specific healthcare needs of your business and employees.